Article Posted August 08, 2011

Use of Major Repair and Renovation Funds

“… MRR funds are generally not made available for use for auxiliary or other facilities housing fee-generating services…”

In a recent audit engagement, we discovered Major Repair and Renovation (MRR) funds allocated for specific projects and purposes were reassigned to other capital projects not previously approved by the Board of Regents, including facilities for auxiliary services.

To mitigate the potential misallocation of MRR funds, we provided several recommendations, including the following:

- Ensure management appropriately identifies current capital needs, plans for future needs, budgets funds appropriately, and monitors the use of funds;

- Develop and maintain a strong relationship with the Office of Real Estate and Facilities (OREF), and incorporate their expertise and guidance into regular business operations;

- Implement strong internal controls related to MRR funds, including the segregation of capital asset management and financial services, adherence to the BOR-approved MRR project list, and the application of funds only to eligible facilities; and,

- Manage auxiliary services and cost schedules in a manner that allows a portion of funds to be reinvested towards the maintenance and capital renewal of those buildings and facilities.

Misuse or poor management of these funds creates a variety of risks:

- Potential loss of future MRR allocations due to non-compliance with BOR guidelines;

- Disallowance of reimbursement requests by Georgia State Financing and Investment Commission;

- Inability to meet bond arbitrage requirements, resulting in delay of future bond sales; and,

- Deterioration of buildings and infrastructure, and inability to support resident instruction needs.

Our audit consisted largely of a reconciliation of historical MRR expenses, with a focus on the physical asset upon which funds were spent. We also examined these transactions for compliance with several useful policy documents that clearly articulate the appropriate allocation and expense of MRR funds: OREF’s “Major Repair and Renovation (MRR) Guidelines,” the State Accounting Office’s “GSFIC Reimbursements for Bond Funded Construction Projects,” and USG’s Business Procedures Manual section 18.1. While MRR funds are generally not made available for use for auxiliary or fee-generating facilities, exceptions can be made for instances of health and life safety issues. The institution indicated the decision to expend these funds for what were otherwise ineligible facilities was based upon the identification of such critical needs, and a lack of alternative fund sources.

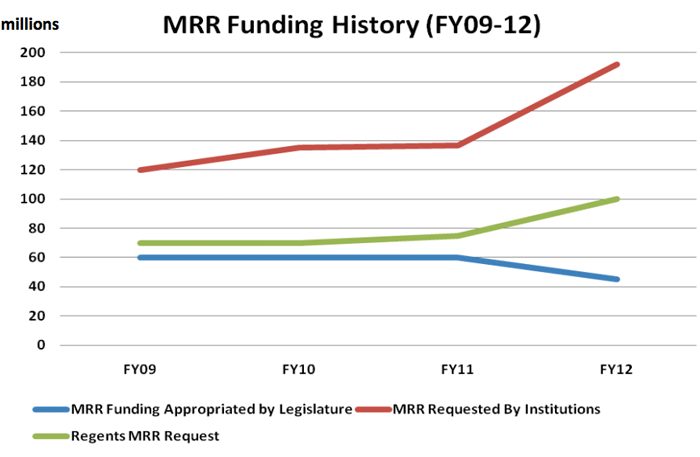

According to the OREF, USG owns and manages over 43.6 million square feet of instructional space, much of which was constructed prior to 1970. In combination with regularly appropriated maintenance and operation funds, MRR funding is allocated in an effort to provide for major repair, replacement, or renovation of critical building systems and other infrastructure. Its primary uses are for smaller scale projects (generally under $1 million) that are beyond the scope of regular annual maintenance costs, and should be spent only on instructional and administrative space. Facilities housing auxiliary functions such as food service and student residences are expected to provide for capital renewal needs through those respective funding streams.

Posted by Ted Beck

Published in: Audit Findings

Most Recent in: Audit Findings

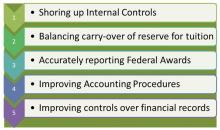

5 Most Common External Audit Issues - FY2011

Posted by Ted Beck

October 25, 2012

Identity and Access Management

Posted by Ted Beck

August 17, 2011

Financial Aid Purge Protections

Posted by Ted Beck

August 02, 2011

View Articles by Category

Search

Contact

Internal Audit & Compliance

Board of Regents of the University System of Georgia

270 Washington Street, SW

Atlanta, GA 30334

Tel.: 404-962-3020

Fax: 404-962-3033

Email: .(JavaScript must be enabled to view this email address)