Article Posted March 26, 2013

Extra Compensation Related to Federal Grants

In the previous publication of the Briefing, we discussed the topic of Internal Control Issues Concerning Grant Awards and provided several examples. In this issue, we will discuss another area of Internal Controls, the payment of extra compensation related to federal grants.

Federal agency regulations control the calculation and characterization of grant related billing. The following discussion provides guidance; however, the final authorities are the grant and contract documents, granting agency policies and procedures, and Circulars for Educational and Non-Profit Institutions 2CFR, part 220 (OMB Circular A-21). Federal guidance is given on additional pay for Faculty researchers. No guidance is given on additional pay for professional staff or administrative staff. As such, this should be addressed on a case by case basis paying close attention to the terms, conditions and policies relevant to the sponsored project and those of the BOR. Also please be aware that overtime pay is appropriate for paying non-exempt employees although the cost of the overtime pay must be allocated proportionately across all accounts paying the salary for a given pay period.

The following authoritative sources are summarized related to the issue of Extra Compensation: 1.BOR Policy 8.3.12.4 addresses Extra Compensation as it relates to Faculty:

a. Research and Saturday classes will ordinarily be carried by USG personnel as part of their normal workload without additional financial compensation. Adequate allowance in time assigned for the extra duties shall be made by a proportionate decrease in the teaching load;

b. Extra compensation may be paid, however, when all four of the following conditions exist: (1) The work is carried in addition to a normal full load, (2) No qualified person is available to carry the work as part of his/her normal load,(3) the work produces sufficient income to be self-supporting, (4) The additional duties are not so heavy as to interfere with the performance of regular duties.

c. Although not stated, it should be understood that extra compensation allowed under state regulations and BOR policy would be typically funded by State appropriations or auxiliary funds. Institutions should follow federal, state, BOR and institutional terms, conditions, policies and procedures, and advanced approvals applicable to the sponsored project concerning use of federal funds for extra compensation.

2.USG Business Procedures Manual, Payroll Section 5.3.2 states: “Extra compensation may be paid to employees for tasks performed after normal business hours for duties not included in the employee’s normal job responsibilities, provided the following three criteria are met;

a. Tasks must be outside of the employee’s regular department; and,

b. The Department Agreement Form must be completed and signed by the appropriate department heads; and,

c. The employee must meet at least one of the criteria listed below (Criteria also can be found in the Official Code of Georgia Annotated Section 45-10-25): Chaplain, Fireman, Dentist, Certified Oral or Manual Interpreter for Deaf Persons, Registered Nurse, Licensed Practical Nurse, Psychologist, Teacher or instructor of an evening or night course or program, Professional holding a doctoral or master’s degree from an accredited college or university, or Part-time employee.

d. An employee meeting all three criteria listed above may be paid extra compensation for a task for another department during normal job hours if the task is not part of the employee’s normal job responsibilities, and the employee takes annual leave for the portion of time used for the task receiving extra compensation.

3.Federal Regulations

a. Only address extra compensation for faculty researchers.

b. NSF11-1 January 2011, Chapter II, C. g.(i) (a) states: “NSF regards research as one of the normal functions of faculty members at institutions of higher education…NSF award funds may not be used to augment the total salary or salary rate of faculty members during the period covered by the term of faculty appointment…”.

c. OMB Circular A-21 J.10.d (1): “Charges for work performed on sponsored agreements …are allowable at the base salary rate. In no event will charges to sponsored agreements … exceed the proportionate share of the base salary for that period…”

d. Exceptions to the process in b. above are rare, but should be included: If faculty members with sponsored support cannot be released from teaching duties, but still perform grant-related research, the situation should be documented, notification sent to the granting agency or prime award recipient (in the case of sub-recipient contracts), and approval received in advance of paying extra compensation.

For Faculty research staff with nine or ten month contracts, summer semester grant effort can result in extra compensation known as summer salary, if included in the approved grant budget.

a. Summer salary calculation involves dividing the contracted base salary by the number of teaching months, usually nine, and multiplying the result by the grant effort percentage times the number of summer months when effort occurred. (Example: For 25 % effort over a period of two summer months: $72,000 base salary divided by 9 = $8,000 per month times 2 months times 25% effort = $4,000 in total summer salary).

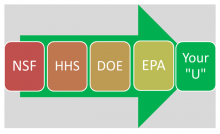

b. National Science Foundation (NSF) restricts the summer salary from grants to two months or 2/9 of the annual contracted pay (NSF Grants Policy Manual, Section 611 1.b.2). HHS, Department of Education, and Department of Energy do not have this restriction.

c. Federal regulations specifically prohibit effort “worked” during Fall or Spring semester and “reported” in the Summer.

To summarize: Federal grant funds normally should not be used as a source for additional pay but instead are used to “buyout” the effort of faculty researchers, i.e., course release time. However, unique circumstances as in the case of faculty who cannot be released from their teaching responsibilities are eligible for extra compensation if permitted by institutional policy and procedures, allowed by the contract, included in the budget, and if approved in advance by the granting agency.

In the event an employee is a research subject, the employee can be compensated for time as a participant from federal funds. USG Business Procedures Manual 5.3.2 states: Under no circumstances should an employee receive extra compensation for a task while receiving normal compensation for the same time period.” Thus, if the employee participates as a research subject during normal work hours, the employee must take leave time in order to receive the extra compensation. Penalties may be imposed for falsely certifying an effort report or incorrectly billing a granting agency. Both the institution and the certifier may be charged with violations of law.

Citations:

•Office of Management & Budget (OMB) Circular A-21 Section J.10 (2 CFR 220)

•NSF 11-1 January 2011, Chapter II – Proposal Preparation Instructions – C. Proposal Contents, 2.g.(i)(a)

•USG Business Procedures Manual, Section 5.3.2 Extra Compensation

•BOR Policy 8.3.12.4

•Georgia Constitution Article III, Section VI, Paragraph VI

•NSF Grants Policy Manual, Section 611 1.b.2

OMB Grant Reform - Policies

The focus on federal accountability and transparency has increased momentum for potential reforms that will have a significant impact on grant recipients. OMB, by Executive Order 13520, evaluated potential reforms to federal grant policies in an effort to increase efficiency, strengthen oversight, and align administrative requirements. Key facets of the Executive Order included:

•Partner with state and local government to combat fraud, waste and abuse •Provide administrative flexibility that is results-oriented, reduces administrative burden, and shifts focus from monitoring compliance to monitoring results

On February 28, 2012, OMB published a notice in the Federal Register about reforming federal policies for cost principles and administrative requirements for grants and cooperative agreements. The most significant reform efforts are the Single Audit and Facilities & Administrative Cost Rates and Time and Effort Reporting. OMB developed a series of reform ideas that standardize information collections across agencies, adopt a risk-based model for Single Audits, and provide new administrative approaches for determining and monitoring the allocation of Federal funds. The reforms were published in the Federal Register February 1, 2013, Reform of Federal Policies Relating to Grants and Cooperative Agreements; https://www.federalregister.gov/articles/2013/02/01/2013-02113

_________________________________________________________________________________________________________________________________________________________________________________________

Sandra Evans, Auditor

Office of Internal Audit

Board of Regents

404-962-3032

Rob Roy, Educational Access

Georgia Institute of Technology

404-385-6120

Posted by OIAC

Published in: Policy Briefs

Most Recent in: Policy Briefs

COSO Internal Control Integrated Framework - 17 Principles

Posted by Randy Pearman

March 27, 2013

When Is the Auditor Audited?

Posted by Michael J. Foxman

March 26, 2013

Internal Control Issues Concerning Grant Awards

Posted by OIAC

October 25, 2012

COSO Internal Control Integrated Framework Proposed Updates

Posted by OIAC

October 25, 2012

Employment Background checks as an Auditable Issue

Posted by Marion Fedrick

October 25, 2012

View Articles by Category

Search

Contact

Internal Audit & Compliance

Board of Regents of the University System of Georgia

270 Washington Street, SW

Atlanta, GA 30334

Tel.: 404-962-3020

Fax: 404-962-3033

Email: .(JavaScript must be enabled to view this email address)